BoT maintains central bank rate at 5.75pc for Q4 2025

The CBR is set by BoT as a benchmark for implementing various monetary operations, including lending to commercial banks. It directly influences interest rates on loans between commercial banks, which are expected to remain within a ±2.0 per cent range of the established CBR

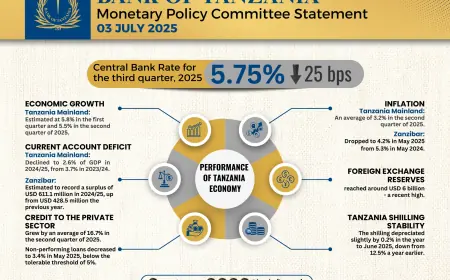

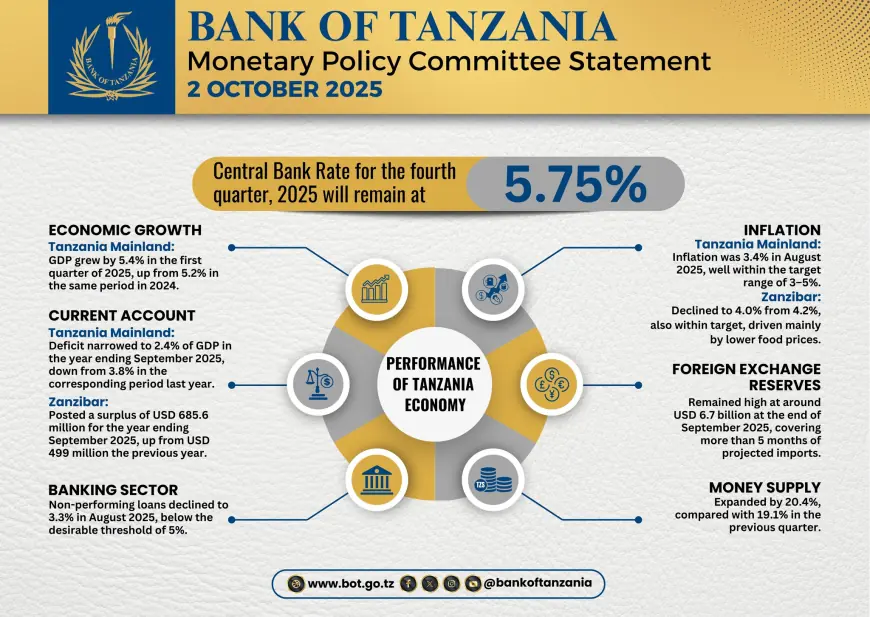

Dar es Salaam. The Bank of Tanzania’s (BoT) Monetary Policy Committee has decided to maintain the Central Bank Rate (CBR) at 5.75 per cent for the fourth quarter of 2025, the same level as in the third quarter, which ended in September.

The CBR is set by BoT as a benchmark for implementing various monetary operations, including lending to commercial banks. It directly influences interest rates on loans between commercial banks, which are expected to remain within a ±2.0 per cent range of the established CBR.

Addressing bank executives, financial institutions, and journalists, BoT Governor, Mr Emmanuel Tutuba, said the decision reflected the central bank’s assessment that the economy is expected to continue growing while inflation remains within the target range of 3 to 5 per cent.

“The decision to maintain the rate stems from an evaluation of inflation trends and economic growth. Inflation stood at 3.4 per cent in August and is expected to remain within the 3–5 per cent target range. Meanwhile, BoT projections indicate that the economy will continue to grow at a satisfactory pace,” Mr Tutuba, who is also Monetary Policy Committee Chairman, said.

He added that monetary policy implementation in the third quarter successfully ensured sufficient liquidity in the economy, leading to a reduction in the seven-day interbank lending rate.

“The central bank utilised its monetary policy tools, particularly short-term lending to banks through reverse repo operations, to boost liquidity. This action strengthened overall liquidity and contributed to a decline in the seven-day interbank lending rate,” Governor Tutuba explained.

Regarding the economic outlook, he noted that domestic economic activities continued to strengthen.

In Mainland Tanzania, the economy grew by 5.4 per cent in the first quarter of 2025, compared with 5.2 per cent in the same period of 2024.

The growth was mainly supported by mining, agriculture, financial and insurance services, construction, and industrial production.

In Zanzibar, the economy expanded by 6.4 per cent in the first quarter of 2025, matching the growth recorded in the same period last year. Key contributors included tourism, construction, and agriculture.

Meanwhile, Tanzania Bankers Association (TBA) Chairman, Mr Theobald Sabi, observed that rising national income, increased foreign currency liquidity, a stronger shilling, and the improved performance of sectors such as tourism, mining, and agriculture contribute to a stable Tanzanian economy.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0