BOT slashes central bank rate to 5.75pc, signalling robust confidence in Tanzania's economic trajectory

The reduction in CBR marks a pivotal shift in the country's monetary policy stance, representing the first adjustment to the CBR since its strategic introduction in the first quarter of 2024, having been meticulously maintained at 6.00 percent for five consecutive quarters

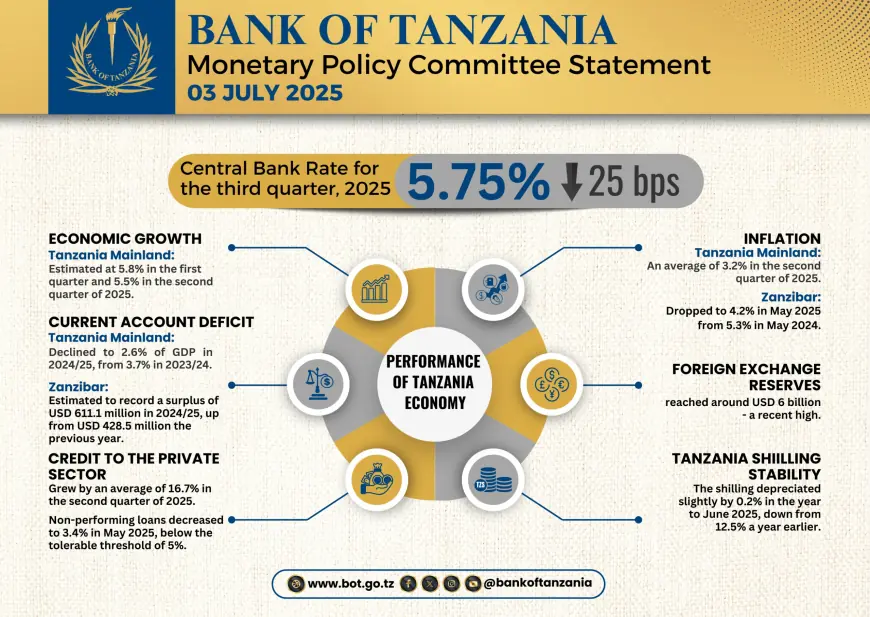

Dar es Salaam. The Bank of Tanzania's (BoT) Monetary Policy Committee (MPC) on July 3 2025, announced a decisive 25-basis point reduction in the Central Bank Rate (CBR), bringing it down to 5.75 percent from its preceding level of 6.00 percent.

This marks a pivotal shift in the country's monetary policy stance, representing the first adjustment to the CBR since its strategic introduction in the first quarter of 2024, having been meticulously maintained at 6.00 percent for five consecutive quarters.

Governor Emmanuel M. Tutuba, who chairs the influential MPC, said that the Committee's unanimous decision is a direct reflection of its profound confidence in the prevailing inflation outlook.

He noted that inflation has consistently and commendably remained within the stipulated target band of 3–5 percent.

“The risks to the outlook are minimal, due to the diversified structure of the economy and consistent implementation of growth-enhancing policies and programs, which are expected to cushion the economy against external shocks,” Mr Tutuba said in a statement released after the MPC meeting.

The statement added that meticulous projections unequivocally indicate that this stability is poised to endure within this desirable range, a testament to the efficacy of prudent monetary and fiscal policies, the timely commencement of the harvest season, and the enduring stability of the exchange rate.

While acknowledging that broader geopolitical tensions and recent tariff hikes have undeniably amplified global uncertainty, Governor Tutuba noted that recent negotiations and agreements suggest a promising moderation of these inherent risks.

Implications for the Tanzanian Economy

This downward adjustment of the CBR is a profoundly significant development with far-reaching implications for the entire Tanzanian economy.

A lower CBR typically precipitates a cascade of reduced borrowing costs for commercial banks operating within the financial system.

This, in turn, is expected to encourage these institutions to judiciously lower their own lending rates for both businesses and individual borrowers, thereby injecting crucial liquidity into the economy.

Analysts say the reduction in the CBR serves as a powerful and unambiguous positive signal for the economy, unequivocally indicating that the central bank holds a firm conviction that inflationary pressures are not just under control, but robustly so.

They add that the strategic move is anticipated to cultivate an even more conducive environment for heightened investment and increased consumption, thereby serving as a potent catalyst to further propel the remarkable economic growth trajectory that has been consistently observed in recent quarters.

The MPC's comprehensive assessment of the domestic economic performance paints a picture of robust and sustained strengthening.

This impressive momentum has been significantly buoyed by substantial public infrastructure investments and a discernible surge in private sector activity, all underpinned by a continually improving business climate across the nation.

Statistical estimates conducted in June 2025 reveal that Mainland Tanzania's Gross Domestic Product (GDP) growth impressively reached 5.8 percent in the first quarter of 2025 and maintained a strong 5.5 percent in the second quarter of the same year.

This commendable growth was primarily propelled by exceptional performance in key sectors such as agriculture, construction, and financial services.

Looking ahead, the domestic economy is robustly projected to continue its upward trajectory, with GDP growth forecasted to accelerate to 6.0 percent in the third quarter and an even more robust 6.9 percent in the fourth quarter.

The Zanzibar economy is also expected to mirror this promising pattern.

This sustained momentum is largely attributed to substantial infrastructure investments spanning railways, roads, airports, and sports facilities, strategically undertaken in preparation for the upcoming CHAN and AFCON tournaments, alongside continuous and significant investment in the vital agriculture and mining sectors.

This optimistic outlook is further reinforced by the compelling findings of both the Market Perception Survey and the CEOs Economic Perception Survey, meticulously conducted in May 2025.

Investor confidence also remains remarkably strong, a sentiment further validated by the Fitch Rating announced in June 2025, which affirmed Tanzania’s credit rating at a solid B+ with a stable outlook.

Direct Impact on Borrowers and the Financial Sector

For the myriad of businesses, both large and small, and for individual citizens across Tanzania, the CBR cut is undeniably welcome news.

Borrowers can reasonably anticipate more favourable and accessible terms on a wide spectrum of loan products, encompassing essential mortgages, crucial business loans for expansion, and various forms of personal credit.

This anticipated easing of credit conditions is expected to stimulate increased demand for credit, thereby facilitating crucial expansion for businesses and making significant purchases more financially accessible for consumers, ultimately fostering broader economic participation.

The financial sector itself remains a beacon of stability and resilience.

The ratio of non-performing loans (NPLs) has commendably declined to a healthy 3.4 percent in May 2025, impressively remaining well below the prudential threshold of 5 percent.

This significant improvement in credit quality, coupled synergistically with the newly implemented reduction in the CBR, is poised to cultivate an even more dynamic and robust lending environment across the banking sector.

The banking sector itself remains highly liquid, consistently profitable, and adequately capitalised, providing a strong foundation for increased lending.

Furthermore, growth in deposits and lending has been significantly bolstered by the continued expansion of agent banking networks, groundbreaking advancements in digital financial services, and the crucial diversification of financial products available to the public.

Navigating Global Headwinds with Domestic Resilience

While the broader global economic landscape undeniably presents its share of inherent challenges, including an increased sense of economic and trade uncertainty largely driven by escalating geopolitical conflicts and the imposition of various tariffs, Tanzania's strategically diversified economic structure and its consistent implementation of growth-enhancing policies are meticulously designed and effectively positioned to cushion the nation against external shocks.

On the global front, inflation has indeed shown signs of moderation across most economies, largely attributable to the lagged effects of prior monetary policy tightening and the moderate pricing of essential food and energy commodities.

However, this moderation has occurred at a somewhat slower pace than previously anticipated, largely due to the persistent uncertainty pervading global economic and trade conditions.

Commodity markets have experienced a diverse and sometimes contradictory trend; notably, gold prices surged dramatically to $3,282.40 per troy ounce by the end of June 2025, a significant increase from $2,855.73 at the end of March 2025.

This surge is largely attributed to heightened geopolitical conflicts and trade tariff risks, which collectively spurred an increased demand for safe-haven assets.

In stark contrast, crude oil prices eased to $65.92 per barrel from an average of $74.35, a reflection of subdued global demand and an increased supply from OPEC+ member countries.

Most central banks globally are expected to meticulously balance inflation risks against the critical need to support economic growth.

Domestically, headline inflation in Mainland Tanzania averaged a subdued 3.2 percent in the second quarter of 2025, a clear reflection of the positive impact of prudent monetary policy and generally subdued price movements in non-food and energy-related items.

However, a temporary uptick in food inflation was observed, primarily driven by transportation disruptions caused by heavy rainfall in certain regions.

Conversely, core inflation eased, significantly supported by a moderation in service prices, particularly in recreation, sports, and culture, as well as essential house maintenance services.

In Zanzibar, headline inflation impressively declined to 4.2 percent in May 2025 from 5.3 percent a year earlier, largely due to lower food prices.

Money supply (M3) continued its moderate expansion, reflecting the increasing needs of burgeoning economic activities.

In the second quarter of 2025, M3 is estimated to have grown at an average annual rate of 19.1 percent, a notable increase from 15.4 percent in the preceding quarter.

This expansion was largely driven by robust private sector credit growth of 16.7 percent, reflecting a discernible easing of financial conditions and a continually improving business environment.

Fiscal performance in both Mainland Tanzania and Zanzibar has commendably supported monetary policy operations.

Revenue collections were precisely on target, underpinned by enhanced tax administration and notably improved compliance.

Expenditure execution was meticulously aligned with available resources, reflecting a steadfast commitment to prudent fiscal management.

The MPC observed that the ongoing implementation of fiscal consolidation and reforms will undoubtedly facilitate sustainable growth and perfectly complement monetary policy in ensuring low and stable inflation.

Public debt increased moderately but crucially remained sustainable, maintaining a moderate risk of debt distress.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0