Optimism as Tanzania ready to license oil and gas blocks in May 2025

The announcement by the Petroleum Upstream Regulatory Authority (PURA) that 26 exploration blocks will be auctioned in May 2025 signals the government's renewed commitment to unlocking its hydrocarbon potential. This move is expected to attract international investors and revitalize Tanzania’s role in Africa’s energy landscape

Tanzania is poised to make a significant leap in its energy sector as the country prepares to launch its first oil and gas licensing round in over a decade.

The announcement by the Petroleum Upstream Regulatory Authority (PURA) that 26 exploration blocks will be auctioned in May 2025 signals the government's renewed commitment to unlocking its hydrocarbon potential. This move is expected to attract international investors and revitalize Tanzania’s role in Africa’s energy landscape.

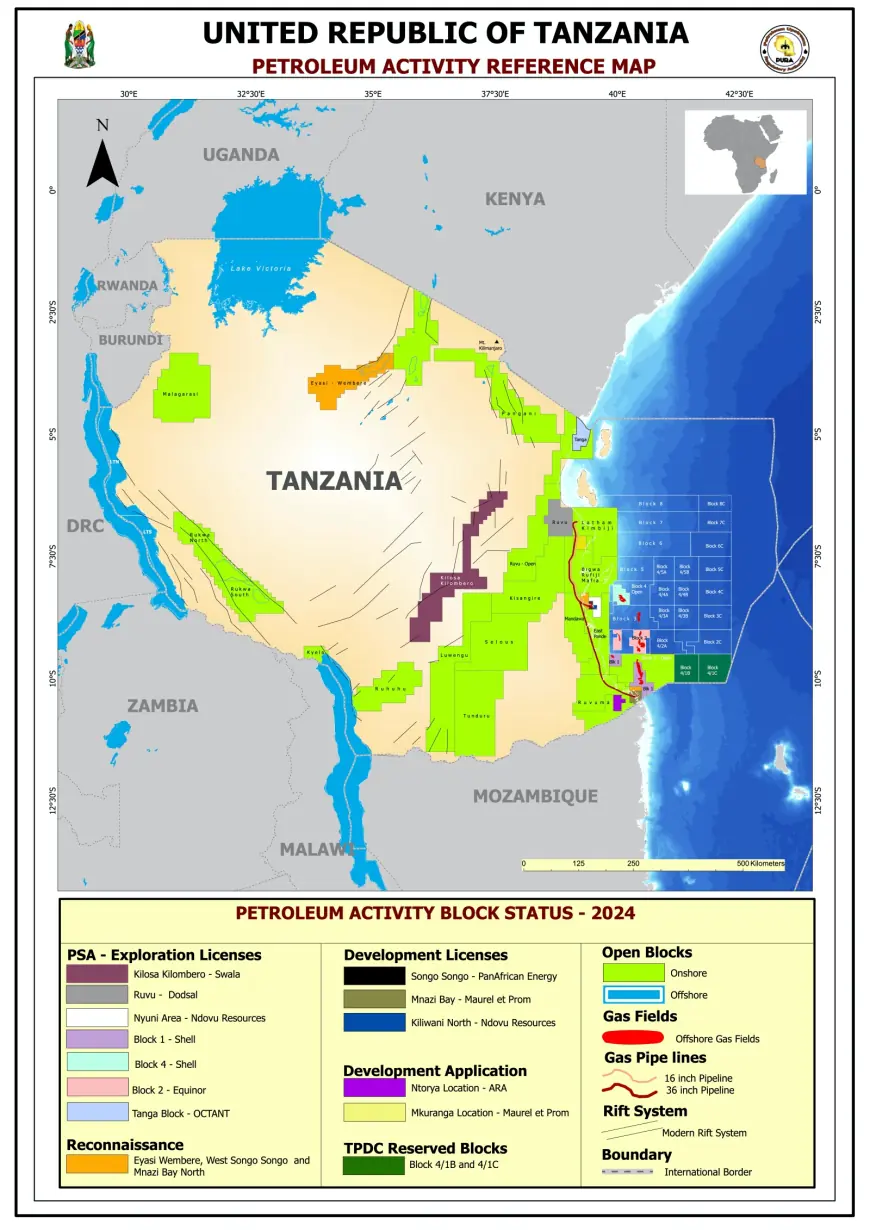

The upcoming licensing round, scheduled to be unveiled at the Africa Energy Summit in London, will mark the country’s fifth such initiative. Among the 26 blocks on offer, three are located in Lake Tanganyika, while the rest are offshore in the Indian Ocean. The decision to launch this bid round aligns with Tanzania’s broader strategy to harness its natural resources and bolster energy security.

According to PURA’s Director General Charles Sangweni, the regulatory body has already identified the blocks, collected relevant data, and is awaiting final government approval of the Model Production Sharing Agreement (PSA).

Mr. Sangweni, in an interview with Bloomberg, stated, "We have identified the blocks, collected data, and are now awaiting the government’s approval of the Model Production Sharing Agreement (PSA), which will govern the terms for investors." The PSA is a crucial document that will outline fiscal terms and contractual obligations for potential investors, setting the framework for the country’s upstream oil and gas operations.

The licensing round coincides with Tanzania’s ongoing efforts to finalize negotiations on a $42 billion liquefied natural gas (LNG) export project. This project, which has been under discussion for nearly a decade, aims to capitalize on the country’s vast natural gas reserves and position Tanzania as a major LNG exporter.

Tanzania boasts substantial gas reserves, with Shell-operated offshore Blocks 1 and 4 containing approximately 16 trillion cubic feet (Tcf) of discovered natural gas. Equinor, operating in offshore Block 2, has made nine discoveries, with estimated in-place gas volumes exceeding 20 Tcf. These reserves highlight Tanzania’s potential to contribute significantly to global energy markets. However, negotiations with major energy companies, including Shell and Equinor, have been hampered by tax incentive disagreements.

Deputy Prime Minister and Minister of Energy Dr. Dotto Biteko has expressed optimism that a resolution on tax issues will be reached by June 2025, paving the way for the LNG project’s final investment decision (FID). If successful, this project could generate substantial revenue for the country and create thousands of jobs.

Tanzania’s oil and gas sector presents significant economic opportunities that could transform the country’s financial landscape. The government projects that with the right policies in place, the sector could contribute up to 10% of the country’s GDP by 2035. Key benefits include:

- Employment Creation: The oil and gas industry has the potential to create thousands of direct and indirect jobs, benefiting sectors such as logistics, engineering, and manufacturing.

- Revenue Generation: The government is expected to collect substantial revenue through taxes, royalties, and profit-sharing agreements with foreign companies.

- Foreign Direct Investment (FDI): The licensing round and associated LNG projects are expected to attract billions of dollars in FDI, boosting Tanzania’s economic development.

- Local Business Growth: The government has introduced policies requiring international oil and gas firms to engage local suppliers, fostering the growth of Tanzanian businesses.

Equally, Tanzania is increasingly positioning itself as a regional energy hub through strategic partnerships and infrastructure projects that promote cross-border energy trade. Key initiatives include:

- East African Crude Oil Pipeline (EACOP): A collaborative effort with Uganda, TotalEnergies, and CNOOC, this project will facilitate crude oil exports from Uganda to Tanzania’s coast.

- Gas Exports to Neighboring Countries: Tanzania is exploring agreements with Rwanda, Kenya, and Zambia for gas exports to enhance regional energy security.

- Participation in the African Continental Free Trade Area (AfCFTA): The integration of Tanzania’s energy sector into AfCFTA will enable smoother trade of oil and gas across African markets.

Despite its vast potential, Tanzania’s oil and gas sector faces several challenges that are being addressed by the government. These challenges include:

- Regulatory Uncertainty: While Tanzania has made efforts to improve its investment framework, periodic policy changes and legal disputes have raised concerns among investors.

- Taxation and Profit-Sharing Disputes: Negotiations over tax incentives and revenue-sharing between the government and multinational energy firms have slowed down major projects.

- Infrastructure Gaps: While investments in pipelines and LNG terminals are increasing, additional funding is required to modernize and expand Tanzania’s energy infrastructure.

- Environmental Concerns: The development of fossil fuel projects is facing growing opposition from environmental activists who advocate for cleaner energy alternatives.

-

Future Prospects: A Path toward Energy Security

Tanzania’s energy sector is at a turning point. While oil and gas remain crucial to the country’s industrialization goals, the government is also exploring renewable energy projects to balance energy security with sustainability. The future of Tanzania’s energy sector will be shaped by:

- Technology and Innovation: The adoption of advanced drilling and extraction technologies will increase efficiency and reduce environmental risks.

- Diversification of Energy Sources: Investments in hydro, solar, and wind energy projects will complement the oil and gas industry, ensuring a balanced energy mix.

- Stronger Institutional Capacity: Continued improvements in governance and transparency within regulatory bodies such as PURA, TPDC, and EWURA will enhance investor confidence.

- Strengthening Local Content Policies: By prioritizing skills development and infrastructure investments, Tanzania aims to ensure that its citizens benefit from oil and gas exploration.

Annex: Procedure for Acquiring Oil and Gas Blocks in Tanzania

Investors interested in acquiring oil and gas exploration blocks in Tanzania must follow a structured process regulated by PURA. The procedure involves several key steps:

- Announcement of Licensing Round – PURA announces the available exploration blocks and publishes relevant details, including location, geological data, and bidding requirements.

- Expression of Interest (EOI) – Interested investors submit an Expression of Interest (EOI) to PURA, indicating their interest in bidding for specific blocks.

- Prequalification Process – Investors must meet technical, financial, and operational requirements to qualify for participation in the bidding round. Companies are evaluated based on their track record, financial capacity, and technological expertise.

- Data Room Access – Qualified bidders gain access to PURA’s data room, where they can review geological, seismic, and other relevant data on the available blocks.

- Submission of Bids – Investors submit their bids, including proposed work programs, financial commitments, and technical capabilities.

- Evaluation and Awarding of Blocks – PURA evaluates bids based on technical feasibility, financial commitment, and compliance with regulatory requirements. The most competitive bidders are awarded exploration licenses.

- Negotiation of Production Sharing Agreements (PSA) – Successful bidders negotiate and finalize the PSA with the government. The PSA outlines fiscal terms, exploration commitments, and local content requirements.

- Regulatory Approvals and Licensing – Once the PSA is finalized, investors obtain the necessary environmental, social, and regulatory approvals before commencing exploration activities.

- Commencement of Exploration Activities – Upon receiving final approval, investors begin exploration, including seismic surveys and drilling operations.

This structured process ensures transparency and competitiveness in Tanzania’s oil and gas sector while enabling the government to attract capable investors.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0